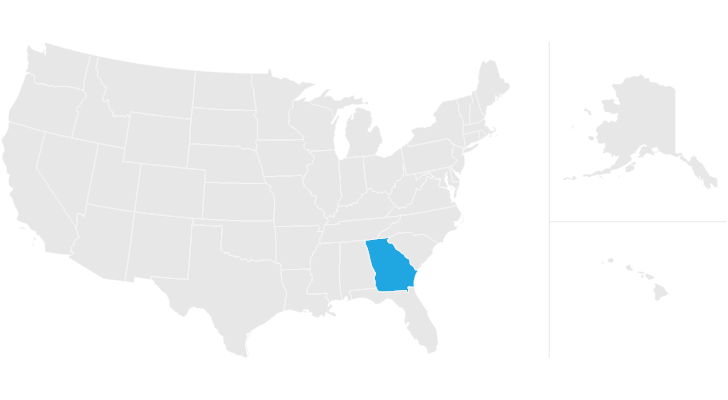

does georgia have an inheritance tax

Georgia does not have any inheritance tax or estate tax for 2012. Twelve states and Washington DC.

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

However the federal exemption equivalent was 3500000 for 2009 5000000 for 2010.

. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. There is no inheritance tax in Georgia. In 2021 federal estate tax generally applies to assets over 117 million.

Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes are levies paid by the living beneficiary who gets the inheritance. What happens if you dont pay your property taxes in GA. Nevertheless you may have to pay the estate tax levied by the federal government.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Lets break down who has to pay it how much and how to minimize it. Alabama alaska arizona arkansas california colorado delaware florida georgia hawaii idaho indiana kansas louisiana michigan mississippi missouri montana nevada new hampshire new mexico north carolina north dakota ohio oklahoma south carolina south.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. The amount paid to Georgia is a direct credit against the federal estate tax. There is no federal inheritance tax and only six states have a state-level tax.

No Georgia does not have an inheritance tax. Inheritance taxes are only in place in some states and Georgia is not one of them. Also called a death tax the estate tax is the final round of taxes someone pays before their property is distributed to their heirs.

The estate tax is paid by the estate whereas the inheritance tax is levied on and paid by the beneficiary who receives a specific bequest. A 1 million estate in a state with a 500000 exemption would be taxed on 500000. Mortgage Calculator Rent vs Buy.

The effective rate state-wide comes to 0957 which costs the average Georgian 155130 a year based on the median home value in the state of 157800. Its based on the value of. Inheritance taxes are applied to a persons heirs after they have already received money from someone who recently died.

Below are the ranges of inheritance tax rates for each state in 2021 and 2022. It is not paid by the person inheriting the assets. Its paid by the estate and not the heirs although it could reduce the value of their inheritance.

The estate of a Georgia resident decedent has property in other states and must pay estateinheritance taxes to those states. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Georgia Inheritance Laws What You Should Know - SmartAsset In this detailed guide of Georgia inheritance laws we break down intestate succession probate taxes what makes a will valid and more.

The tax is paid by the estate before any assets are distributed to heirs. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. There is no federal inheritance tax but there is a federal estate tax.

The estate tax is different from the inheritance tax. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. The exact federal rules depend on the year in which your parent died.

Georgia Estate Tax and Georgia Inheritance Tax. However Georgia residents may still be on the hook for inheritance taxes if the state where. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current fairly high.

An inheritance tax is paid by beneficiaries on inherited money or property. 2 An estate tax is a tax on the value of the decedents property. Georgia has no inheritance tax.

Impose estate taxes and six impose inheritance taxes. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. Across the state rates range from a low of 045 percent in Fannin County to a high of 166 percent in Taliaferro County.

As a result there are 32 states that dont collect death-related taxes. How do I compute the Georgia tax. An inheritance tax is a tax on the property you receive from the decedent.

Georgia Inheritance Tax and Gift Tax. As of July 1 2014 Georgia does not have an estate tax either. Maryland is the only state to impose both.

Just five states apply an inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Another states inheritance tax could still apply to Georgia residents though.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. So Georgians are only responsible for federally-mandated estate taxes in cases in which the deceased and their heirs reside in Georgia. En español Most people dont have to worry about the federal estate tax which excludes up to 117 million for individuals and 234 million for married couples in 2021 up from 1158 million and 2316 million respectively for the 2020 tax year.

And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. Georgians are only accountable for federally-mandated estate taxes in cases in which the decedent and their beneficiaries live in Georgia. Estate taxes also called inheritance taxes are the taxes paid on the assets left to the family of a deceased person.

Any deaths that occurred after July 1 2014 fall under this code.

Inheritance Tax Poised For A Comeback In The Post Covid Era Bloomberg

Palmistry Palm Reading Signs And Lines Of Win Luck Success Signs Of Inheritance Fortune Palmistry Palm Reading Palm Reading Lines

Family Trust Vs Llc Family Trust Trust Llc

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Georgia Estate Tax Everything You Need To Know Smartasset

Pin On Retirement Infographics

Inheritance Taxation In Oecd Countries En Oecd

Georgia Estate Tax Everything You Need To Know Smartasset

Real Estate Bird Dogs Wanted Attention All Real Estate Bird Dogs My Company Is Willing To Pay You T Cash From Home Wholesale Real Estate Distressed Property

What Is An Irrevocable Trust Infographic Https Www Assetprotectionpackage Com What Is An Irrevocable T Revocable Trust Types Of Trusts Setting Up A Trust

Wills And Trusts Kit For Dummies Aaron Larson 9780470283714 In 2021 Dummies Book Estate Planning Checklist Setting Up A Trust

The 10 Most Miserable States In America States In America Wyoming America

Pin By M J On Estate Planning In 2021 Estate Planning Annuity How To Plan

Lightning Protection New Jersey 1 800 557 9037 Lightning Rod Instal Lightning Rod Infographic Marketing Protection

Britons Throwing Away Hundreds By Way Of Easy Inheritance Tax Errors In 2022 Inheritance Tax Inheritance Take Money

Top 10 Bank Logos Explained Logodesign Graphicdesign Branding Bank Banks Logo Bank Branding Finance Logo

Pierre Bonnard Painting Arcadia Pierre Bonnard Painting Watercolor Paintings Abstract

Watch Mail For Debit Card Stimulus Payment In 2021 Prepaid Debit Cards Visa Debit Card Debit

Bulky Item Recycling Alternatives Recycling Recycling Education Ways To Recycle